Expert insights that power growth

Stay ahead of industry shifts with e123’s white papers, blog, podcast, and videos designed for health plans, carriers, distributors, and agents. Explore proven strategies to simplify distribution, ensure robust compliance, and pay commissions to grow faster.

“Insuring Growth explores the biggest challenges and opportunities facing health insurance leaders, focusing on what executives need to know now.”

Brendan

President, e123

Resources

White Papers:

Deep dives for leaders

Download in-depth research and guidance from e123’s 20+ years in health insurance distribution. Each white paper is designed to help executives solve today’s toughest challenges and prepare for tomorrow’s opportunities.

Videos

Struggling with complex hierarchies, commissions, or compliance? We’ve put together guides and resources to help carriers and distributors simplify operations and grow with confidence.

Empowering Agents

On a scale from 1 to 10, how important is tech-enabling agents?

Resource Allocation

How much should an FMO or Agency spend on distribution technology?

The Data Dilemma

How can I get reliable data?

Tech Strategy

How do I decide where to use technology first?

Future Glimpse

What will Medicare Products look like in 2030?

Competitive Edge

Isn't it a competitive advantage to build our own technology platform?

ICMG Keynote Panel Discussion: The Future of Health Insurance Marketing

How Technology and the Right Data Can Enhance Insurance Marketing Amid New Trends and Regulations

Blog

Grow with confidence and stay ahead with the latest resources and insights for health insurance distribution.

- e123 Blog

Tags:

- Agent/Broker, Health Plans/Carriers, Insurance distribution

- e123 Blog

Tags:

- Agent/Broker, Data, FMOs, Health Plans/Carriers

- e123 Blog

Tags:

- Agent/Broker, Health Plans/Carriers, Insurance distribution

- Brendan's Blog

Tags:

- Agent/Broker, FMOs, Health Plans/Carriers, Insurance distribution

- e123 Blog

Tags:

- Agent/Broker, FMOs, Health Plans/Carriers, Insurance distribution

- e123 Blog

Tags:

- FMOs, Health Plans/Carriers

- e123 Blog

Tags:

- Health Plans/Carriers

- Brendan's Blog

Tags:

- FMOs, Health Plans/Carriers

- e123 Blog

Tags:

- FMOs, Health Plans/Carriers

- e123 Blog

Tags:

- FMOs, Health Plans/Carriers

- e123 Blog

Tags:

- FMOs, Health Plans/Carriers

- Brendan's Blog

Tags:

- FMOs, Health Plans/Carriers

- Brendan's Blog

Tags:

- FMOs, Health Plans/Carriers

- e123 Blog

Tags:

- Agent/Broker, Commission management, Data, FMOs, Health Plans/Carriers, Insurance distribution

- Brendan's Blog

Tags:

- Agent/Broker, Commission management, Data, FMOs, Health Plans/Carriers, Insurance distribution

- Brendan's Blog

Tags:

- Agent/Broker, Commission management, Data, FMOs, Health Plans/Carriers, Insurance distribution

- e123 Blog

Tags:

- Agent/Broker, Commission management, Data, FMOs, Health Plans/Carriers, Insurance distribution

- Brendan's Blog

Tags:

- Agent/Broker, Commission management, Data, FMOs, Health Plans/Carriers, Insurance distribution

- Brendan's Blog

Tags:

- Agent/Broker, Commission management, Data, FMOs, Health Plans/Carriers, Insurance distribution

- Brendan's Blog

Tags:

- Agent/Broker, Commission management, Data, FMOs, Health Plans/Carriers, Insurance distribution

- Brendan's Blog

Tags:

- Agent/Broker, Commission management, Data, FMOs, Health Plans/Carriers, Insurance distribution

- Brendan's Blog

Tags:

- Agent/Broker, Commission management, Data, FMOs, Health Plans/Carriers, Insurance distribution

- e123 Blog

Tags:

- Agent/Broker, Data, FMOs, Health Plans/Carriers, Insurance distribution, Medicare

- e123 Blog

Tags:

- Agent/Broker, Commission management, Data, FMOs, Health Plans/Carriers, Insurance distribution, Medicare

- e123 Blog

Tags:

- Agent/Broker, Commission management, Data, FMOs, Health Plans/Carriers, Healthcare Regulations, Insurance distribution, Medicare

- e123 Blog

Tags:

- Agent/Broker, Data, FMOs, Health Plans/Carriers, Healthcare Regulations, Insurance distribution

- e123 Blog

Tags:

- Insurance distribution, Medicare

- e123 Blog

Tags:

- Agent/Broker, Commission management, FMOs, Health Plans/Carriers, Insurance distribution

- Brendan's Blog

Tags:

- Insurance distribution, Medicare

- e123 Blog

Tags:

- Agent/Broker, Commission management, Data, FMOs, Health Plans/Carriers, Insurance distribution

- Brendan's Blog

Tags:

- Insurance distribution

- e123 Blog

Tags:

- Agent/Broker, Commission management, Data, FMOs, Health Plans/Carriers, Insurance distribution

- e123 Blog

Tags:

- Agent/Broker, Commission management, Data, FMOs, Health Plans/Carriers, Insurance distribution

- e123 Blog

Tags:

- Agent/Broker, FMOs, Health Plans/Carriers, Healthcare Regulations, Insurance distribution, Medicare

- Brendan's Blog

Tags:

- Agent/Broker, AI, FMOs, Health Plans/Carriers

- Brendan's Blog

Tags:

- Agent/Broker, AI, FMOs, Health Plans/Carriers

- e123 Blog

Tags:

- Agent/Broker, FMOs, Health Plans/Carriers, Healthcare Regulations, Insurance distribution, Medicare

- Brendan's Blog

Tags:

- Agent/Broker, AI, FMOs, Health Plans/Carriers

- e123 Blog

Tags:

- Client Testimonial, Commission management, Insurance Innovation Podcast

- e123 Blog

Tags:

- Agent/Broker, FMOs, Health Plans/Carriers, Insurance distribution

- Brendan's Blog

Tags:

- Agent/Broker, AI, FMOs

- e123 Blog

Tags:

- Agent/Broker, Data, FMOs, Health Plans/Carriers

- Brendan's Blog

Tags:

- Agent/Broker, AI, FMOs, Health Plans/Carriers

- Brendan's Blog

Tags:

- Agent/Broker, AI, Health Plans/Carriers

- e123 Blog

Tags:

- Agent/Broker, Data, FMOs, Health Plans/Carriers

- Brendan's Blog

Tags:

- Agent/Broker, AI, FMOs, Health Plans/Carriers

- e123 Blog

Tags:

- Agent/Broker, Data, FMOs, Health Plans/Carriers

- e123 Blog

Tags:

- Agent/Broker, AI, FMOs, Health Plans/Carriers

- e123 Blog

Tags:

- Client Testimonial, Commission management, Insurance distribution, Insurance Innovation Podcast

- Brendan's Blog

Tags:

- Agent/Broker, AI, FMOs, Health Plans/Carriers

- e123 Blog

Tags:

- Agent/Broker, Commission management, FMOs, Health Plans/Carriers

- Brendan's Blog

Tags:

- Agent/Broker, AI, FMOs, Health Plans/Carriers

- e123 Blog

Tags:

- Agent/Broker, Commission management, FMOs, Health Plans/Carriers

- Brendan's Blog

Tags:

- Agent/Broker, AI, Brendan's Blog Posts, FMOs, Health Plans/Carriers

- e123 Blog

Tags:

- Agent/Broker, Commission management, FMOs, Health Plans/Carriers

- Brendan's Blog

Tags:

- Agent/Broker, AI, Brendan's Blog Posts, FMOs, Health Plans/Carriers

- e123 Blog

Tags:

- Agent/Broker, Commission management, FMOs, Health Plans/Carriers, Healthcare Regulations

- Brendan's Blog

Tags:

- Agent/Broker, AI, Brendan's Blog Posts, FMOs, Health Plans/Carriers

- e123 Blog

Tags:

- Agent/Broker, Client Testimonial, FMOs, Health Plans/Carriers, Insurance Innovation Podcast

- Brendan's Blog

Tags:

- Agent/Broker, AI, Brendan's Blog Posts, FMOs, Health Plans/Carriers

- e123 Blog

Tags:

- Agent/Broker, Commission management, FMOs, Health Plans/Carriers

- Brendan's Blog

Tags:

- Agent/Broker, AI, Brendan's Blog Posts, FMOs, Health Plans/Carriers

- Brendan's Blog

Tags:

- AI, Brendan's Blog Posts, FMOs, Health Plans/Carriers

- Brendan's Blog

Tags:

- Agent/Broker, AI, Brendan's Blog Posts, FMOs, Health Plans/Carriers

- e123 Blog

Tags:

- Insurance Innovation Podcast

- Brendan's Blog

Tags:

- Agent/Broker, AI, Brendan's Blog Posts, FMOs, Health Plans/Carriers

- Brendan's Blog

Tags:

- Agent/Broker, AI, Brendan's Blog Posts, FMOs, Health Plans/Carriers

- e123 Blog

Tags:

- Agent/Broker, FMOs, Health Plans/Carriers, Insurance distribution

- e123 Blog

Tags:

- Client Testimonial, Insurance Innovation Podcast

- e123 Blog

Tags:

- Client Testimonial, Insurance Innovation Podcast

- e123 Blog

Tags:

- Client Testimonial, Insurance Innovation Podcast

- e123 Blog

Tags:

- Insurance Innovation Podcast

- e123 Blog

Tags:

- Client Testimonial, Insurance Innovation Podcast

- e123 Blog

Tags:

- Insurance Innovation Podcast

- e123 Blog

Tags:

- Client Testimonial, Insurance Innovation Podcast

- e123 Blog

Tags:

- Client Testimonial, Insurance Innovation Podcast

- e123 Blog

Tags:

- Client Testimonial, Insurance Innovation Podcast

- e123 Blog

Tags:

- Agent/Broker, Data, FMOs, Health Plans/Carriers

- e123 Blog

Tags:

- Client Testimonial, Insurance Innovation Podcast

- e123 Blog

Tags:

- Client Testimonial, Insurance distribution

- e123 Blog

Tags:

- Agent/Broker, Client Testimonial, FMOs, Insurance distribution

- e123 Blog

Tags:

- Agent/Broker, FMOs, Health Plans/Carriers, Medicare

- e123 Blog

Tags:

- Agent/Broker, Client Testimonial, FMOs

- e123 Blog

Tags:

- Agent/Broker, FMOs, Health Plans/Carriers, Medicare

- e123 Blog

Tags:

- Agent/Broker, Client Testimonial, FMOs

- e123 Blog

Tags:

- Agent/Broker, FMOs, Health Plans/Carriers, Medicare

- e123 Blog

Tags:

- Agent/Broker, Client Testimonial, FMOs

- e123 Blog

Tags:

- Agent/Broker, Client Testimonial, FMOs

- e123 Blog

Tags:

- Agent/Broker, FMOs, Health Plans/Carriers

Insuring Growth Podcast

Insuring Growth, hosted by Brendan McLoughlin, e123’s President, explores the biggest challenges and opportunities facing health insurance leaders, focusing on what executives need to know now.

Join us for bold conversations with industry executives and changemakers shaping the future of health insurance.

Insurance Innovation Podcast

Insurance Innovation, hosted by Alan Edgin, focuses on topics that matter to health insurance marketers.

Join us for engaging discussions with executives who bring a wide range of experiences across insurance and distribution channels.

Case Study

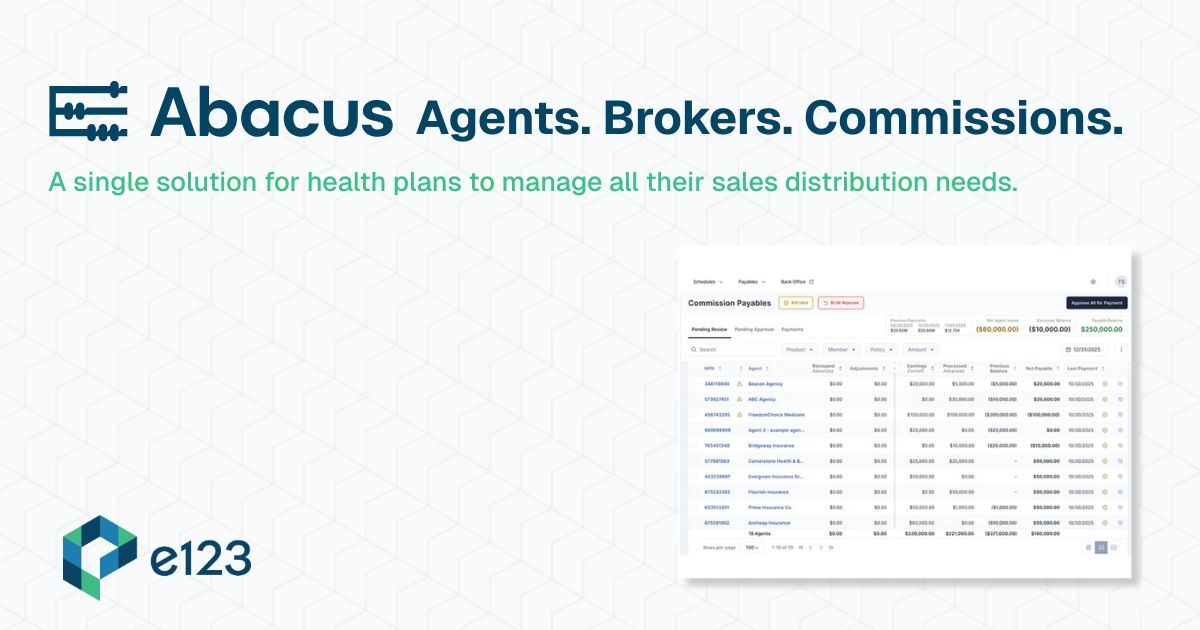

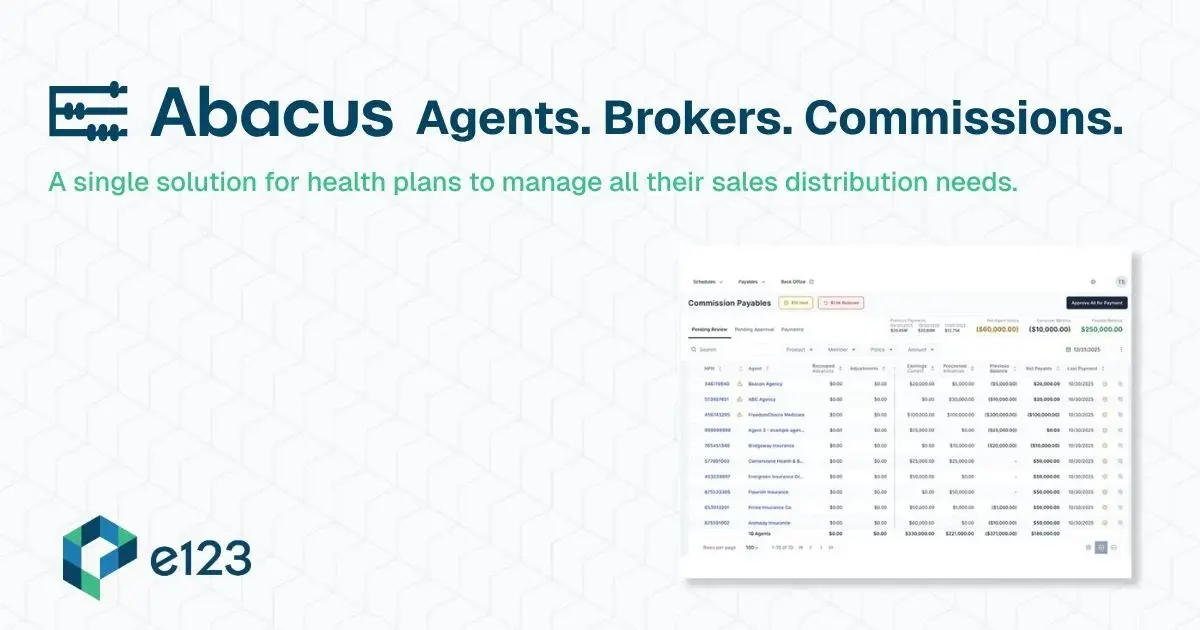

National Plan – Commercial Group Insurance

A national health plan needed to grow agent distribution and enable bundled sales across multiple products, while managing readiness and commissions efficiently.

e123 centralized agent contracting, onboarding, and commission workflows in Abacus to support multi-product selling and reduce manual touchpoints. This resulted in an expanded agent footprint and increased product-per-member ratios through smarter bundling and channel management.

Regional Plan — Medicaid to Medicare Advantage Transition

A regional plan was anticipating reduced Medicaid funding and needed to pivot toward Medicare Advantage (MA), but lacked front-office capabilities to support agent engagement and competitive growth. Through e123’s Abacus solution, the plan was able to modernize agent onboarding, streamline appointment tracking, and ensure MA-readiness without disrupting existing back-end operations. This helped position the plan to enter MA confidently with the tools needed to recruit, engage, and retain agents in a more competitive landscape.

Regional Plan — Medicare Advantage Growth

A regional plan struggled to hit aggressive Medicare Advantage enrollment targets, with fragmented agent workflows, low visibility into performance during the annual enrollment period (AEP), and inconsistent commission structures slowing growth. They partnered with e123 to implement Abacus to unify agent workflows, automate commissions, and provide real-time performance insights, enabling the plan to identify high-impact opportunities and pivot quickly during AEP. The plan ended up exceeding AEP enrollment goals by 150% of forecast, driven by improved agent productivity, better targeting, and faster decision-making. Moreover, this success established a repeatable growth model for future enrollment periods.

“e123 gave us control and clarity. We went from reactive problem-solving to a system that drives growth.”

Alisa Hester

VP, Distribution Operations

Supercharge your most valuable distribution channel

Schedule a demo today and see why leading health plans and distributors trust e123 to optimize their agent/broker network.