Austin Siegel, COO of NEO Insurance, a nationally recognized insurance agency and field marketing organization (FMO), sat down with Alan Edgin at the Medicarians 2023 Conference to discuss a variety of trends taking place in the insurance space.

Spanning many topics, Austin enlightened Alan on:

- Top requests downlines have for FMOs

- Tips in transitioning to Medicare Advantage and over 65 plans

- The tools and data necessary to expand sales

Insurance Innovation, brought to you by e123 – the premiere life and health distribution management system.

Episode Transcript:

Narrator

Welcome to the Do’s and Don’ts, our series that builds on best practices for insurance marketers carriers and marketing organizations based on white papers from leading thinkers on the future of insurance distribution and of our own course from our e123, CEO, Fred Studier. With me today is Austin Siegel. Welcome to the show. Thank you for being part of the panel discussion earlier today [at Medicarians]. Can you tell us a little bit about your background and what got you interested in being a panelist?

Austin

Most definitely. First of all, thank you for having me, Alan. I am currently the Chief Operating Officer at [Churchill Innovative Holdings] and Neo Insurance Solutions, which is an insurance marketing organization (IMO) in the originally under 65 market. And we entered the over 65 market a little bit over two years ago. And I participated in the panel today because I thought it was a great opportunity to meet with like minds and hear their thoughts on the state of applying technology to the Medicare sales business.

Alan

Okay, great. Thanks. So let’s pick up on what was discussed in the panel and add some more detail and thought for our listeners. Here’s a quote from the white paper that was discussed from Bain and Company, defining a new model for the future must be complemented with practical initiatives for the first steps. Insurers, agencies and brokers may want to test new advisory formats with a pilot that includes the target operation model and technology platform. Austin, how would you look at piloting a new initiative for distribution? Would you pick a particular product line or are you market oriented? How would you work with that?

Austin

Yeah, I mean, given that we’ve been in the space for about two years and are relatively new to it, we actually entered by Piloting on a product specific basis. So when we looked at the over 65 market, we decided that for the way that we approached the market, Medicare Advantage was the right entry point. And so we kind of began by piloting Medicare Advantage sales in almost a beta test mode, sort of stopping incrementally to take a look at our performance and adjust and calibrate everything from our lead sources and how our leads were generated and targeted to actual sales practices and post sales practices in order to kind of fine tune the performance of our agencies to where we wanted it to be.

Alan

So I know you were historically under 65. Why not long term care? Why was it Medicare Advantage for you?

Austin

I think it was the value proposition of Medicare Advantage products to the consumer. I mean, in a world where the there are so many options and some of them come at very high cost to consumers and to seniors and others come at little to no added cost, we saw the Medicare Advantage product as almost a perfect solution for the over 65 market and one that’s gained a tremendous amount of traction in the past seven years or so.

Alan

So when you were doing your testing, what were some of the variations? What were some of the things that you tried to look at besides, obviously the value prop?

Austin

A large part of it was less testing. It was more kind of Iterative deployment and evaluation in the moment. I think that when you’re talking about existing in a sales environment like met care, where you’re really dealing with live consumers in real time, one of the challenges is you’ve got to approach in a way that really mitigates risk. Because, unfortunately, you make a bad sale or something else happens that comes back. So you need to prevent that from happening before it occurs. So we took a highly Iterative approach. We focused on basically biting off very small chunks at a time, getting a small batch of sales done, being able track that sales through various reporting channels to understand how the business performed and as an agency, how we were compensated on the business. And so kind of gauging that out and then looking at what worked, what didn’t work, where we had deficiencies and needed more information was critical to sort of calibrating our approach to the market.

Alan

And does that change yearly? Quarterly? Where you have to reevaluate?

Austin

Absolutely. I think that on an annual basis there’s a swath of new products released into the market by incumbent carriers, by smaller regional carriers and understanding the breadth of those offerings as well as how they’re evolving and the impact of those evolutions to your book of business is pretty critical. And so that was coming into our second year, something we really paid a lot of attention to.

Alan

Oh, that’s great. Here’s another quote from the white paper I want to ask you about. Agent appetite for digital tools has never been greater. Our May survey on US agents during the crisis found that 44% of agents rated either agent digital tools or customer tools as the number one capability insurers can invest in to support them right now. What tools or data do you need that you’re not getting from a carrier or an upline?

Austin

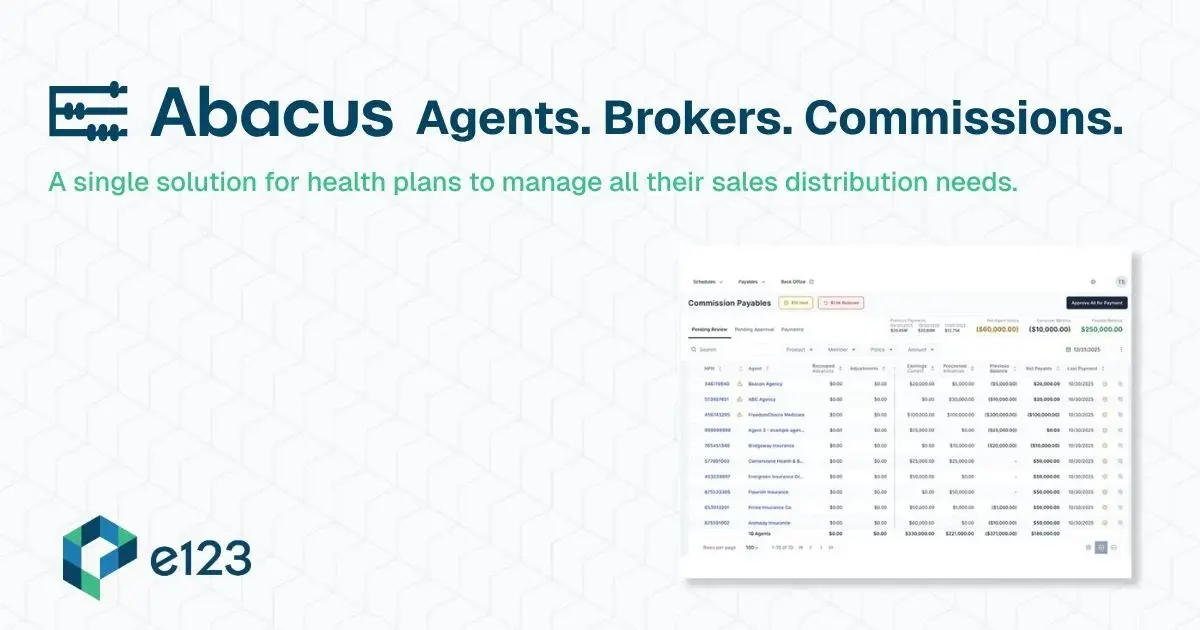

Now, that’s a really great question. So I think from a technology perspective, in terms of tools, information available in the space, there is an incredible amount on the front end, presale and during sale. And you see a lot of really high quality, really well built out platforms that have great comparison shopping capabilities and really allow you to try to locate, based on data points, the best plans for your consumers. I think that where there’s a gap currently, is the post sale data and post sale systems that manage your book of business and give you information. And whether you’re looking at that from what can be referred to as retention or consumer engagement perspectives, or whether you’re looking at that simply from the perspective of how do I consolidate as an agency or as a field marketing organization (FMO), my activity across the totality of my carrier base and kind of bring that back into one harmonized view. There’s a shortage of tools that do that right now in the market.

Alan

So playing on that theme, what’s the biggest ask from your downlines?

Austin

The biggest ask from our downlines is clear consolidated data. We’re dealing with right now, I think nine carriers, and each carrier has different reporting. And most of the carriers make a lot of reporting available, a lot of data available. But it’s all in kind of different formats. They all have proprietary systems and portals that they built as a carrier. And that’s great when you’re a broker working specifically for that carrier. It becomes a challenge when you’re offering a multitude of products from half a dozen or more carriers and you’re trying to get one view of all of your activities.

Alan

And they all have their specific metrics that they’re looking for or wanting or asking for. So yeah, it makes it a little more difficult to. So what is holding you back from investing in more digital tools?

Austin

I think that we, as a field marketing organization (FMO) have been, and I think we’ve really started to work with partners, including e123 to try to figure out how we can put together platforms that consolidate our information for us and offer not just an additional bit of value to our agencies, but really deep insights into their data and their performance so that they can understand how to calibrate their sales to be more effective.

Alan

Great. Do you see opportunities to work better with carriers for digital tools?

Austin

Absolutely. And I think carriers are starting to make digital tools available. Earlier we heard from Aetna and the fact that Aetna is beginning to roll out APIs to give accessibility to their data to their agencies and agents. I think that trend needs to continue. And it’s interesting because while the carriers have all kind of come forward and done a really good job of putting together their proprietary interface and proprietary tools, it’s tough. It’s tough to jump from one carrier’s office to the other on the enrollment side and on the back end data side.

Alan

Okay, well, that kind of encapsulates what we’re trying to do. Thank you again for participating in the panel this morning and then participating in this. And your thoughts were very insightful, and we wish you nothing but the best. Thank you.

Austin

Likewise. Thank you.

Narrator

Thanks for listening to this week’s episode of Insurance Innovation, brought to you by e123. We hope you enjoyed the show. Please provide feedback and let us know topics that would inspire you on the website at e123insurtech.com, home of the premier life and health insurance distribution management system.

If you’d like to be featured as a guest or tell us about someone you’d like to hear us interview, please reach out. We’ll see you next time.